buy carbon credit exchanges

Carbon credit exchanges are gaining popularity as a means to trade emissions. They provide a way for buyers and sellers to do business in real time. They are starting to become available in various locations, and can be used by both professionals and consumers. However, they are not yet fully developed, and may have several flaws.

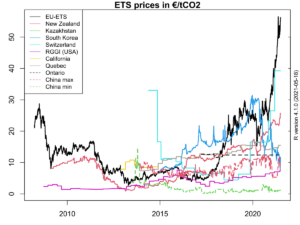

carbon credit exchange are based on the amount of carbon dioxide in the atmosphere. They are sold or bought by companies and organizations that want to reduce their greenhouse gas emissions. This system allows organizations to meet their emission reduction goals without cutting their production. There are many factors that determine the price of carbon credits. Some of the most important are geography, the nature of the underlying project, and the delivery time.

A number of different industries are now leveraging carbon markets to help hedge the financial risks of an energy transition. These include airlines, tech companies, and oil and gas majors. In addition, more industry sectors are setting net-zero targets.

why would you buy carbon credit exchanges

Whether you are a landowner, a trader, or an institutional investor, a carbon exchange can offer you a great investment opportunity. They allow you to participate in real-time business, and the prices you pay are based on the value of the carbon credits in the market. You can also invest in them through Exchange-Traded Funds (ETFs) and futures contracts. These are the most accessible ways to invest in carbon credits. If you are considering purchasing a carbon ETF, you’ll want to be patient. The price of the shares will fluctuate over time, and you should expect a high level of volatility.

The AirCarbon Exchange is an international digital exchange platform that launched in Singapore in 2019. It has more than 130 client organizations and raised $3.6 million in funding in three rounds. ACX uses Distributed Ledger Technology to create securitized carbon credits. These credits can be purchased in four currencies, including AUD, GBP, EUR, and USD.

In Europe, the EU Emissions Trading System regulates the carbon market. Since its introduction in 2005, the ETS has been the largest carbon market in the world. In its last year, it traded over $851 billion in carbon dioxide permits. The ETS has been a driving force behind the rise of the carbon market.

The ETS has also adopted new rule books that will make it even more difficult to exploit loopholes. Carbon offsets are also a great source of much-needed finance for mitigation projects. These offsets can be purchased from farmers and companies that plant trees to prevent carbon dioxide from escaping into the atmosphere. They can also be bought through programs that fund renewable energy projects.

Carbon markets are not completely developed, and they still have some flaws. For example, the United Nations has not endorsed any one particular carbon credit type, so there is no single market for all types of projects. In addition, the price of carbon credits can vary dramatically, depending on the nature of the underlying project. Nevertheless, the market has grown in recent years due to the Paris Agreement.